Multiple debt repayment calculator

Personal loans are different as payments are fixed and designed to clear the amount you owe by the end of the agreement usually one to five years. The Annual Percentage Rate APR shown is for a personal loan of at least 10000 with a 3-year term and includes a relationship discount of 025 Your actual APR may be higher than the rate shown.

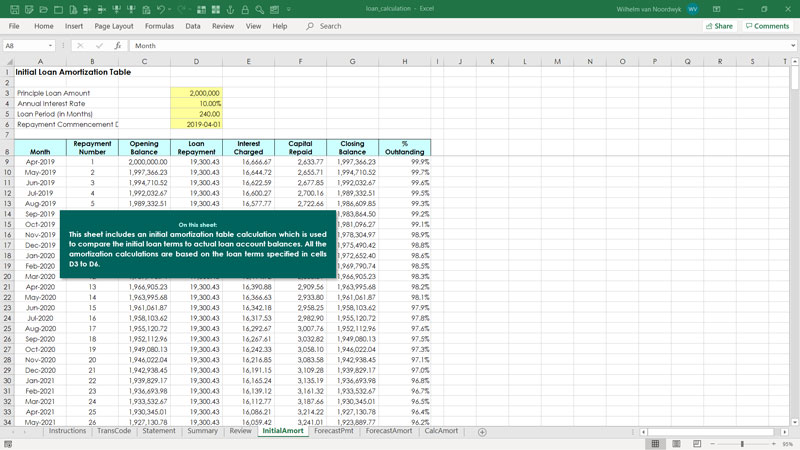

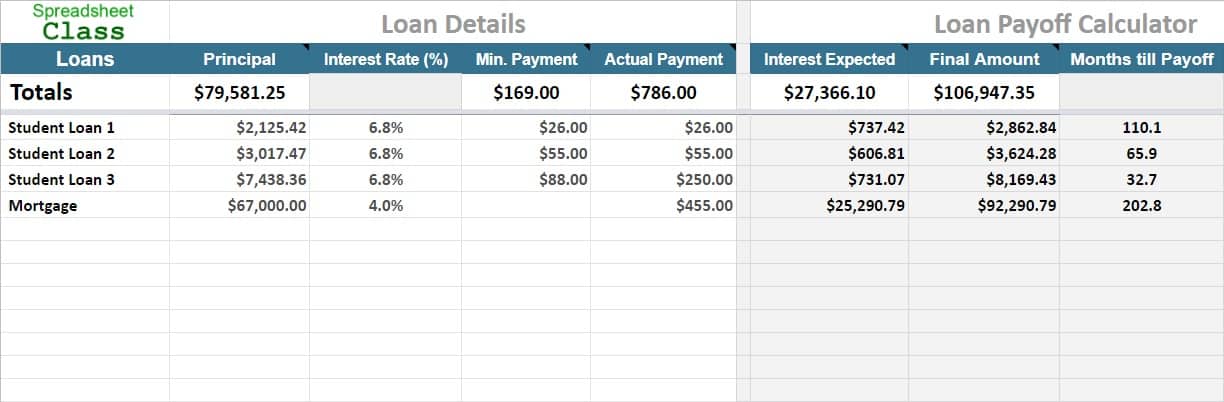

Loan Calculator Template Excel Skills

Start by entering your creditors current balance interest rates and monthly payments to see your current total debt average interest rate and.

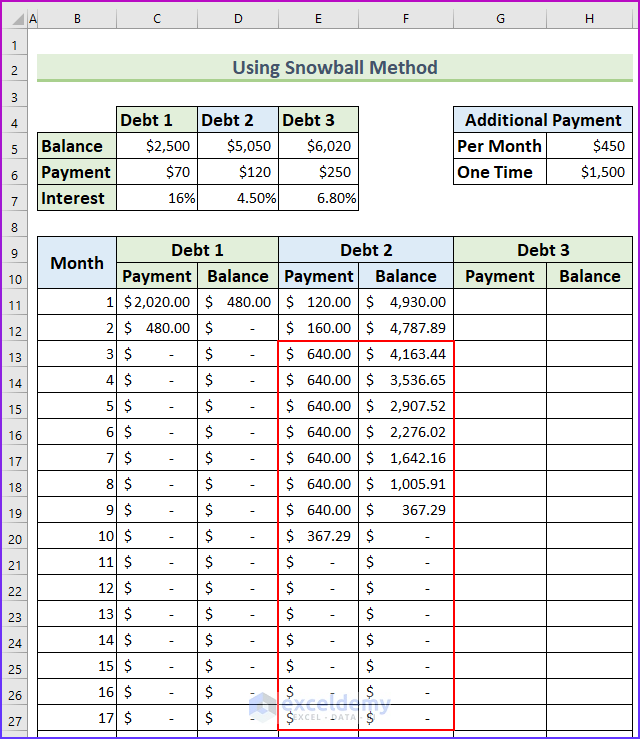

. The Debt Payoff Calculator above can accommodate a one-time extra payment or multiple periodic extra payments either separately or combined. If you have multiple debts to repay then try this Debt Snowball Calculator to repay faster using the rollover method. However for the average Joe the most.

With an avalanche the debt with the highest interest rate is paid first which saves you money in the long run. See how our debt avalanche calculator can help you minimize the interest charges and accelerate debt repayments if you have multiple debts. Enter your loan details including the loan amount loan period type of loan interest rate and repayment information.

This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidate your existing debts into a single fixed rate loan. The Loan Repayment Program LRP is a special incentive that the Army offers to highly qualified applicants entering the Army. When we found the debt reduction calculator we ran multiple preprogramed scenarios and a couple of our own and discovered the optimum method for us.

A debt consolidation loan can also enable you to combine two or more other debts such as credit cards into a single monthly repayment. Throw as much money as you can on your smallest debt that means paying more than the minimum payment. Use our home loan repayment calculator to find out how much your ongoing mortgage repayments could be and the amount of interest youll need to pay over the life of your home loan.

Look for a Summary Box which should contain the minimum repayment for your card. Always make sure youre prioritizing your essential needs when determining how much you can afford for debt repayment. The Debt Reduction Calculator saved us hours of time a quarter of a million dollars and will result in our paying off all loans in 12 the time.

Squawkfox Debt-Reduction Spreadsheet. Find out how long it will take to pay back your loan with or super simple Loan Repayment Calculator. Try a standard 5 for starters then play what-if games with different rates.

Not sure what that is. The results will not be accurate for some of the alternate repayment plans such as graduated repayment and income contingent repayment. With a snowball debts are paid starting with the lowest balance first helping you knock out small debt quickly.

25 years for borrowers with grad school debt. Before deciding to pay off a debt early borrowers should find out if the loan requires an early payoff penalty and evaluate whether paying off that debt faster is a wise decision financially. It usually looks something like Greatest of 1 of balance plus interest 225 of balance or 5.

The LRPs counteract that financial pressure by repaying up to 50000 annually of a researchers qualified educational debt in return for a commitment to engage in NIH mission-relevant research. Debt snowball and debt avalanche are two effective strategies for paying off credit card debt. Educational Loan Minimum Monthly Payments.

Australian Lending Centre are here to help you. Personal loans will usually have lower interest rates than the existing debt making paying off debts faster. Individuals who have multiple high-interest debts can take out a personal loan to consolidate all payments into a singular monthly payment.

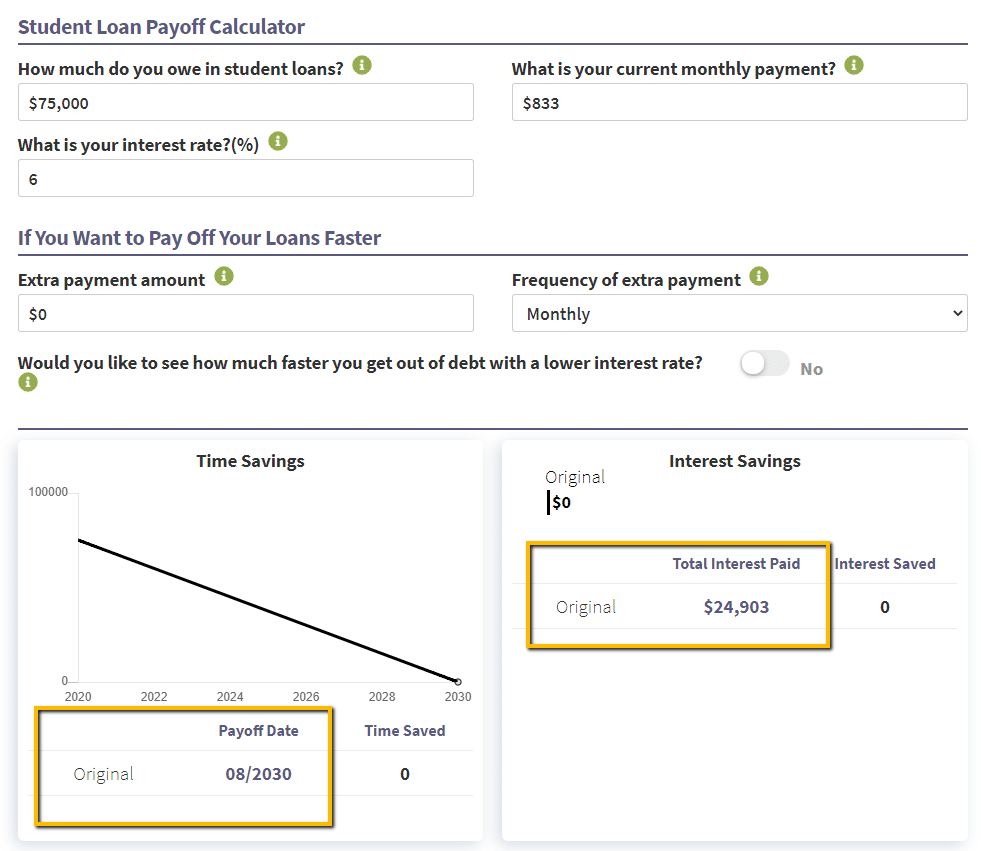

In this example youd need to enter 225 in the of outstanding debt field and 5 in with a minimum. This debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next regularly scheduled payment. When taking out any loan be sure that the interest rate you will be paying is less than the interest rate on your debts its of little use to pay off one lender only to end up paying more through.

If your multiple debts are out of control and you want help with lowering fees and interest lowering monthly repayments or help to pay them all on time we have a number of. The interest rate you are currently paying or the average interest rate across the multiple loans you have. The calculator bases the results on a slope of 1 vertical inch for each 12 horizontal inches.

Only specified Military Occupational Specialties MOSs qualify for the LRP. For multiple home loan. By the end of your mortgage term usually 25 to 30 years you will have repaid everything and own your house outright.

The calculator also assumes that the loan will be repaid in equal monthly installments through standard loan amortization ie standard or extended loan repayment. The award provided me the confidence and clout to move forward with multiple. Use this tool to get an award estimate.

With a repayment mortgage you pay back some of the principal debt every month. Repeat until each debt is paid in full and youre debt-free. You have multiple high-interest debt balances.

Under the LRP the Army will repay part of a Soldiers qualifying student loans. If you have multiple debts then use this Debt Snowball Calculator to plan the fastest way to get out of debt using the rollover method. The Wheelchair Ramp Calculator determines the ramp length defined as the level horizontal distance from the wall of the building to end of the ramp and the slope length defined as the distance from the bottom of the door to the end of the ramp.

When you pay more than your minimum monthly payment be sure to let your student loan servicer know that you want the extra payment to go toward the principal. The author of the spreadsheet and the Squawkfox blog Kerry Taylor paid off 17000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. How fast can I get out debt and how much will I save by adding a one-time additional payment to principal.

Your largest balance is a high. Income-Contingent Repayment ICR caps. Student Loan Hero is wholly-owned by LendingTree a Marketing Lead Generator and Duly Licensed Mortgage Broker with its main office located at 1415 Vantage Park Dr.

Its the same story with credit cards if you opt to just pay the minimum monthly repayment as your payments mainly service the interest rather than clearing the debt. In the case that a credit card holder falls very deeply into debt debt consolidation which is a method of combining all debt under a new line of credit can offer temporary relief. Debt consolidation.

Thanks for sharing a great way to evaluate and. Charlotte 28203 Telephone Number 866-501-2397 TDDTTY. For more information or to do calculations involving debt consolidation please visit the Debt Consolidation Calculator.

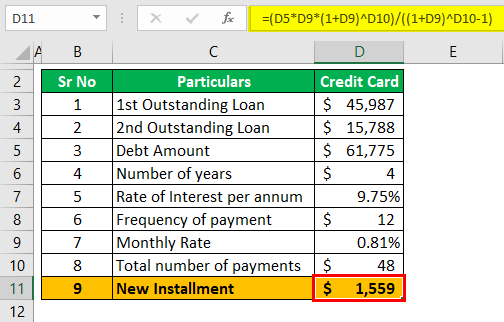

Schedule Loan Repayments With Excel Formulas

Student Loan Payoff Calculator Updated For 2022 Student Loan Planner

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022

Debt Consolidation Calculator How To Consolidate Your Loans

Debt Repayment Calculator Credit Karma

Deleveraging Debt Repayment And Lbo Value Creation Calculator

Debt Payoff Calculator Estimate Your Debt Free Date Credello

Credit Card Payoff Calculator Excel And Google Sheets Free Download

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

Loan Payoff Calculator Know Your Debt Free Date Credello

Loan Payoff Calculator Template For Google Sheets

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

How To Create Credit Card Payoff Calculator With Snowball In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Student Loan Consolidation Calculator Simplify Your Loans Earnest

Extra Payment Calculator Is It The Right Thing To Do