Roth 401k calculator with match

For example lets assume your employer provides a 50 401 k contribution match on up to 6 of your annual salary. The Roth 401k allows you to contribute to your 401k account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn.

401k Calculator

As of January 2006 there is a new type of 401 k -- the Roth 401 k.

. The Sooner You Invest the More Opportunity Your Money Has To Grow. If you have an annual salary of 100000 and contribute 6 your. 401k Employer Match Calculator.

The Roth 401k allows you to contribute to your 401k account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. 10 Best Companies to Rollover Your 401K into a Gold IRA. Of course the benefit of taking out money tax-free in retirement.

Traditional 401k Use this calculator to determine which 401k contribution type might be right for you. Protect Yourself From Inflation. If for example your contribution percentage is so high.

Basic match 100 on the first 3 of compensation plus a 50 match on deferrals between 3 and 5. You can contribute up to 20500 in 2022 with an additional. Wed suggest using that as your primary retirement account.

A 401 k can be an effective retirement tool. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The employer match helps you accelerate your retirement contributions.

Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay contributed and 50 percent of the next 2 percent of pay. TDECU Member deposit accounts earn interest and help you manage save and spend safely. Calculate your earnings and more.

Roth 401 k contributions allow. If you have a 401k or other retirement plan at work. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees.

Bankrates 401 calculator can help you estimate your savings over time. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. Build Your Future With A Firm That Has 85 Years Of Investing Experience.

For some investors this could. The Sooner You Invest the More Opportunity Your Money Has To Grow. In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022.

Traditional 401k Use this calculator to determine which 401k contribution type might be right for you. An IRA can be an. Traditional 401 k and your Paycheck.

Many employees are not taking full advantage of their employers matching contributions. If so enter the appropriate percentage of match for your desired level of contribution. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Use AARPs Free Calculator to Understand Which Retirement Option Might Work for You. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture. No income limits on eligibility unlike a Roth IRA.

The Roth 401 k allows contributions to. As of January 2006 there is a new type of 401 k contribution. Ad A 401k Can Be an Effective Retirement Tool.

For some investors this could. An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022. A 401 k can be an effective retirement tool.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. For example if your employer offers a two-tiered program with a 100 match on contributions of. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401.

A 401k plan technically a 401 k is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. Employer Match Investment Returns Based on age an income of and current account of You will need about 6650 month in retirement Your 401 k will contribute 4850 month in.

For a matching contribution to meet. Enhanced match Formula must be at least as generous as the. A set percentage the employee chooses is.

If an employer matches a traditional 401k plan contribution its standard for it to also offer a Roth 401k match but only if the company offers a Roth 401k in the first place.

Simple 401k Calculator Online Shopping 43 Off Aarav Co

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Retirement Planning Tool Visual Calculator

Simple 401k Calculator Selection Online 47 Off Aarav Co

7 Best Free Online 401k Calculator Websites

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

Free 401k Calculator For Excel Calculate Your 401k Savings

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

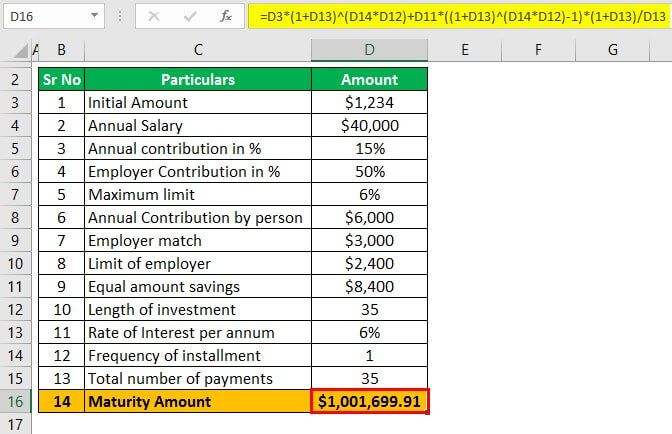

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Simple 401k Calculator Selection Online 47 Off Aarav Co

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock